Do I need to collect sales tax at craft fairs, and how do I do it?

Most jurisdictions require sales tax collection, and clear signage plus accurate rates keep it smooth.

The Narrative

The Empathy

You want to charge customers correctly, but tax rates and rules feel complicated. You worry about making a mistake at checkout or being questioned by customers.

The Education

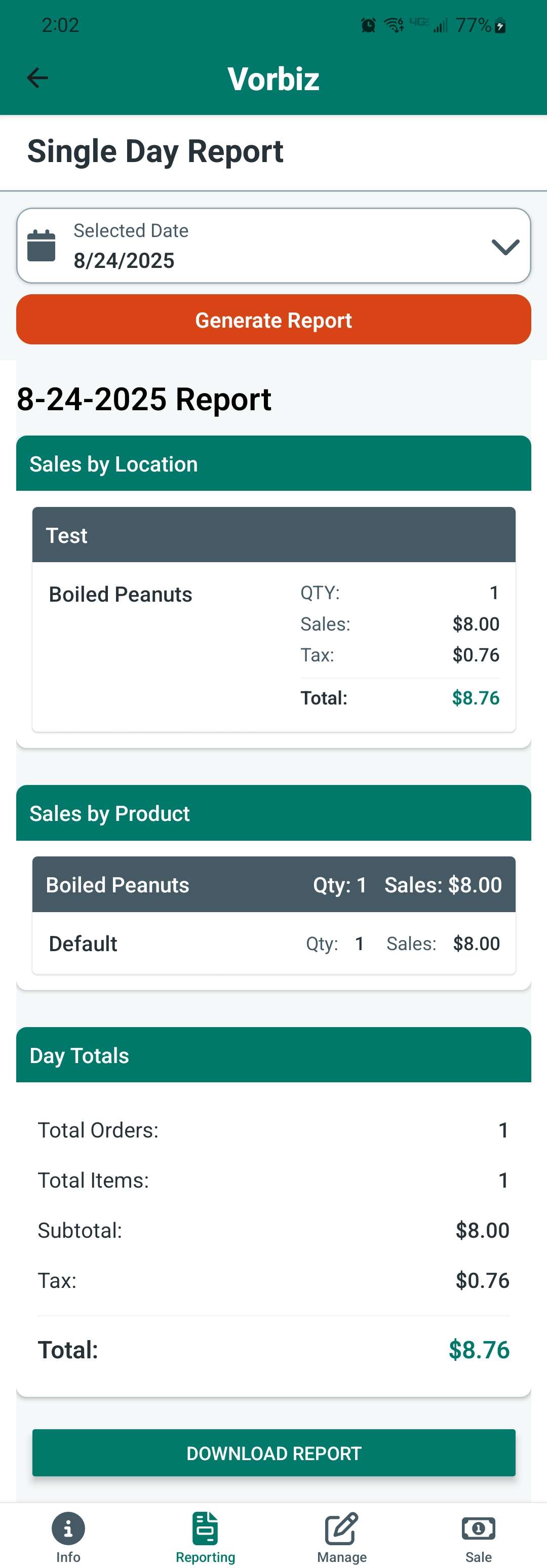

Sales tax rules depend on your state and sometimes the specific city or county where the fair is held. Many vendors either add tax at checkout or build it into the price. Adding at checkout keeps pricing transparent but requires clear signage. Building it in simplifies transactions but requires you to calculate the net tax amount correctly. Either way, you need to track the tax collected separately from your revenue.

The Solution

Check the event location's current tax rate and set it in your point-of-sale system. Post a small sign that says "Sales tax added at checkout" or "Tax included" so customers are not surprised. Save daily totals of tax collected so filing later is easy and accurate.

Should I build sales tax into prices or add it at checkout?

Both options are acceptable as long as you are consistent and transparent. Adding tax at checkout keeps your price tags clean and makes the tax explicit. Including tax in the price makes transactions faster but requires you to calculate and report the tax portion correctly.

- Use clear signage so customers know whether tax is included.

- Set your POS to match your pricing method and rate.

- Track the tax portion separately even if it is baked into the price.

Is it okay not to charge sales tax if I'm very small?

Most states still require tax collection once you make retail sales, even if your business is small or occasional. Some areas have thresholds or exemptions, but you should confirm with your state or local tax agency before skipping tax at a fair.

- Check if your state has a small-seller threshold.

- Ask the event organizer about local requirements.

- When in doubt, collect and remit to stay compliant.